International Monetary Fund

IMF Home page with links to News, About the IMF, Fund Rates, IMF Publications, What's New, Standards and Codes, Country Information and featured topics.

About the IMF The International Monetary Fund (IMF) is an organization of 188 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world. Introduction to the IMF, its membership, role in the global economy, and work with other institutions..

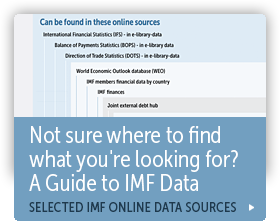

On this site, the term "country" does not in all cases refer to a territorial entity that is a state as understood by international law and practice. As used here, the term also covers some territorial entities that are not states. Dependent territories of member countries are listed alphabetically followed by a description of the constitutional relationships with their member countries. The IMF publishes a range of time series data on IMF lending, exchange rates and other economic and financial indicators. Manuals, guides, and other material on statistical practices at the IMF, in member countries, and of the statistical community at large are also available. Provides comprehensive access to IFS, BOPS, DOTS, GFS and free access to a range of additional IMF datasets. The BOPS yearbook includes annual aggregate and detailed time series for balance of payments and international investment position for countries; provides world and regional tables of balance of payments components and aggregates; and descriptions of methodologies, compilation practices and data sources used by individual countries. Re-disseminates IMF member countries' data on international reserves and foreign currency liquidity in a common template and in a common currency (the U.S. dollar). Historical data by country and selected topics are also available. Provides data and detailed metadata reported on a regular basis by a first batch of member countries for 12 core and 28 encouraged FSIs. Countries may report monthly, quarterly, semiannual, or annual FSIs for dissemination. The IMF will aim over time to expand the list of reporting member countries. Notes provided by IMF staff ahead of a series of meetings held by the G-20 deputies and ministers. They provide a summary of global economic prospects at the time of the respective meeting. IMF Financial Data by Country Summary of IMF members' relations with the Fund More End-of-period quarterly data on the currency composition of official foreign exchange reserves. Data presented in CSV and PDF are aggregated data. Data now available also through IMF eLibrary-Data. The General Data Dissemination System Guide for Participants and Users—The General Data Dissemination System provides member countries with a basic framework for a broader national statistical development strategy. It covers a set of statistics recognized to be essential for all countries for policy making and analysis in an environment that increasingly requires relevant, comprehensive, accurate, and timely statistics available to the general public. The guide explains the nature and objectives of the system, describes its operation, and provides practical guidance on participation in the system. The Special Data Dissemination Standard Guide for Subscribers and Users—The Special Data Dissemination Standard was established by the Fund in 1996 to provide guidance to countries that have or seek access to capital markets, to disseminate key data so that users in general, and financial market participants in particular, have adequate information to assess the economic situations of individual countries. This guide reflects developments in the SDDS since 2007 (when the guide was last published) and also aims to prepare GDDS participants for subscription to the SDDS. The Special Data Dissemination Standard Plus Guide for Adherents and Users— The SDDS Plus was established in October 2012 as a third tier of the IMF's Data Standards Initiatives to address data gaps revealed during the global crisis. It includes an additional nine data categories. The guide elaborates in detail the requirements for these nine data categories. Provides operational advice to IMF member countries that are subscribers to the Special Data Dissemination Standard regarding how to complete the prescribed (mandatory) monthly Data Template on International Reserves and Foreign Currency Liquidity. 2013 EDS Guide provides comprehensive guidance for the measurement, compilation, analytical use, and presentation of external debt statistics. The 2013 EDS Guide was produced by the IMF in conjunction with other members from the Inter-Agency Task Force on Finance Statistics (TFFS). 2003 External Debt Statistics: Guide for Compilers and Users (2003 EDS Guide) updated by the 2013 EDS Guide. The Public Sector Debt Statistics-Guide for Compilers and Users (PSDSG) provides comprehensive guidance for the measurement, compilation, analytical use, and presentation of public sector debt statistics. The PSDSG was produced by the IMF in conjunction with other members from the Task Force on Finance Statistics (TFFS). Full text is available in: Arabic | Chinese | English | French | Russian | Spanish Update of the Monetary and Financial Statistics Manual (MFSM) and the Monetary and Financial Statistics Compilation Guide (MFSCG) The MFSM and MFSCG, published by the IMF in 2000 and 2008, respectively, are being updated to (i) align their contents with the 2008 System of National Accounts (SNA), the sixth edition of Balance of Payments and International Investment Position Manual (BPM6), and the Government Finance Statistics Manual (2014); and (ii) incorporate a number of methodological and operational enhancements. The IMF Statistics Department (STA) is leading this work with the view to complete the pre-publication draft by end-April 2015. As part of this process, the current MFSM and MFSCG will be merged in one single document, i.e., a joint manual and compilation guide. Central bank officials responsible for MFS have been invited to contribute to this effort, including by reviewing and providing comments throughout the envisaged process. The draft of the new Monetary and Financial Statistics Manual and Compilation Guide (MFSMCG) has now been completed and posted below for public comment. The current version of the draft MFSMCG reflects (i) the conclusions of the MFS Experts Group (MFSEG) meeting at IMF Headquarters in February, 2012; and (ii) the comments of the MFSEG members on the earlier draft. We welcome all interested parties to review and provide comments on the draft MFSMCG by September 12, 2014. Please send your comments via email in the format of your preference to STAFIAST@imf.org and mfsmcgrev@imf.org. Please note that the MFSMCG is still a draft and is subject to further revisions. In particular, the standardized report forms (SRFs) for monetary data reporting to the IMF are preliminary and subject to revisions following the general public comment. Compilers are advised not to change their reporting systems based on these preliminary forms. The IMF Statistics Department will finalize and release the revised SRFs with the pre-publication draft of the MFSMCG by end-April 2015. Chapter 1: Introduction Chapter 2: Framework for Monetary and Financial Statistics Chapter 3: Units and Sectors Chapter 4: Classification of Financial Assets and Liabilities Chapter 5: Stocks, Flows and Accounting Rules Chapter 6: Money, Liquidity, Credit, and Debt Chapter 7: Compilations, Source Data, and Dissemination of Monetary Statistics Chapter 8: Financial Statistics Appendix 1: Monetary and Financial Statistics and Other Macroeconomic Statistics Appendix 2: Illustrative Sectoral Balance Sheets/Standardized Report Forms (SRFs) IMF and OECD held a Conference on Strengthening Sectoral Position and Flow Data in the Macroeconomic Accounts at IMF headquarters February 28-March 2, 2011. Users and compilers of official statistics from the G-20 and other advanced economies shared experiences, discussed information gaps in their sectoral accounts, and agreed on a template based on existing statistical frameworks that would help to set national priorities for the compilation and dissemination of an internationally comparable minimum set of sectoral balance sheet, accumulation, and flow of funds accounts. In July 2007, the Working Group on Securities Databases (WGSD), originally established in 1999, was reconvened in response to various international initiatives and recommendations to improve information on securities markets. The members of the WGSD are the European Central Bank (ECB) (chair), the Bank for International Settlements (BIS), the IMF, and the World Bank. Selected experts from national central banks, who have participated actively in various international groups that have identified the need to improve data on securities markets, have also been invited to contribute to the deliberations of the WGSD. The Handbook on Securities Statistics is the first publication of its kind to focus exclusively on securities statistics. Part 1 of the Handbook, which deals with debt securities issues, was published in May 2009. Part 2 of the Handbook, covering debt securities holdings, was published in September 2010. Part 3 of the Handbook focusing on equity securities, was released in November 2012. As part of the G-20 Data Gaps Initiative and responding to the needs for better understanding cross-border exposures of financial and nonfinancial corporations, a working group comprising the BIS, the ECB, the IMF, and the OECD have prepared an inventory of these statistics. The inventory identifies 29 databases that are maintained by the BIS, ECB, IMF, OECD, and the World Bank; and include information on various aspects of cross-border exposures of financial and nonfinancial corporations. The inventory can be accessed through the Principal Global Indicators (PGI) website of the Inter-Agency Group on Economic and Financial Statistics under the Additional Data Sources tab. Update on the Financial Soundness Indicators Reference Group (FSIRG) Meeting The FSIRG met at IMF Headquarters in Washington, DC, during November 15-16, 2011, to review the current list of core (12) and encouraged (28) financial soundness indicators (FSIs) in the context of the G – 20 Data Gaps Initiative. Representatives from 32 countries and 10 international organizations attended the meeting. The FSIRG's Summary of Key Points and Conclusions has been posted publicly. Based on this document, the IMF's Statistics Department (STA) has developed a work program on FSIs that will culminate with the production of a revised FSIs Compilation Guide (Guide) expected by the end of calendar year 2015. It is envisaged that the revised Guide will address methodological and data compilation issues for newly added FSIs and other modifications to the current list of FSIs, as reported to the IMF's Executive Board in November 2013 (see Board Paper Modifications to the Current List of Financial Soundness Indicators). The FSIRG and the broader community of national authorities of countries that are regular FSIs reporters to STA will remain closely engaged throughout this process.

The International Monetary Fund (IMF) is an organization of 188 countries, working to foster global monetary cooperation, secure financial stability, facilit..

The International Monetary Fund (IMF) is an international organization that provides financial assistance and advice to member countries. This article will ..

The IMF plays three major roles in the global monetary system. The Fund surveys and monitors economic and financial developments, lends funds to countries ..

About the IMF

The International Monetary Fund (IMF) is an international organization headquartered in Washington, D.C., in the United States, of 188 countries working to ..

Breaking news about International Monetary Fund. Find the latest articles, videos, photos and blogs about International Monetary Fund.

The IMF released on its website the quarterly data on the currency composition of official foreign exchange reserves (COFER) on March 31, 2015. COFER data ..

About the IMF. The International Monetary Fund (IMF) is an organization of 188 countries, working to foster global monetary cooperation, secure financial ..